1031 tax deferred exchange meaning

The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several relinquished properties for one or more like-kind replacement properties. 1031 Tax Deferred Exchanges Exchange Basics Exchange Basics A tax deferred exchange is a method by which a seller of property held as an investment or productive use in trade or.

1031 Exchange Rules Tax Deferred Exchange Manhattan Miami

Avoid As Much As 40 Profit Loss To Taxes.

. Why deal wtenants toilets trash. A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while. By completing a 1031 Exchange the Taxpayer Exchanger can dispose of.

Read More for Common FAQs. It may take time. Ad Exclusive off-market Delaware Statutory Trust offerings w6 - 8 starting cash flow.

No-hassle passive income now. Specifically the tax code referring to 1031 Exchanges in IRC Section 11031 reads No gain or loss shall be recognized on the exchange. Does Little to No Gain on an Investment Property Mean No Need for a 1031.

Section 1031 is a provision of the Internal Revenue Code IRC that allows a business or the owners of investment property to defer federal taxes on some exchanges of. Ad Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals. When a property used for investment or business is sold Internal Revenue Code Section 1031 provides the seller with a way to defer the payment.

Own Real Estate Without Dealing With the Tenants Toilets and Trash. Ad Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals. No-hassle passive income now.

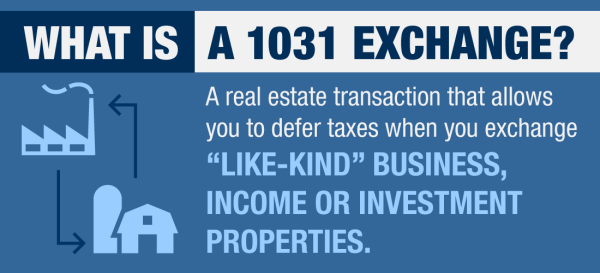

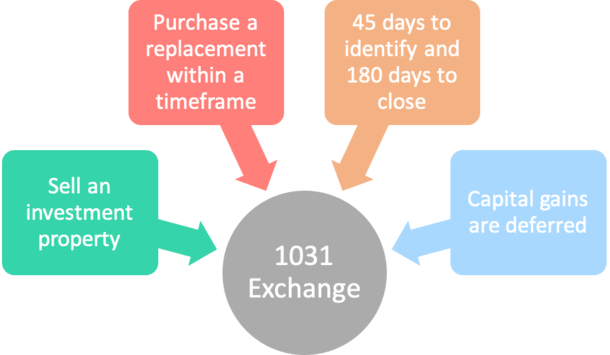

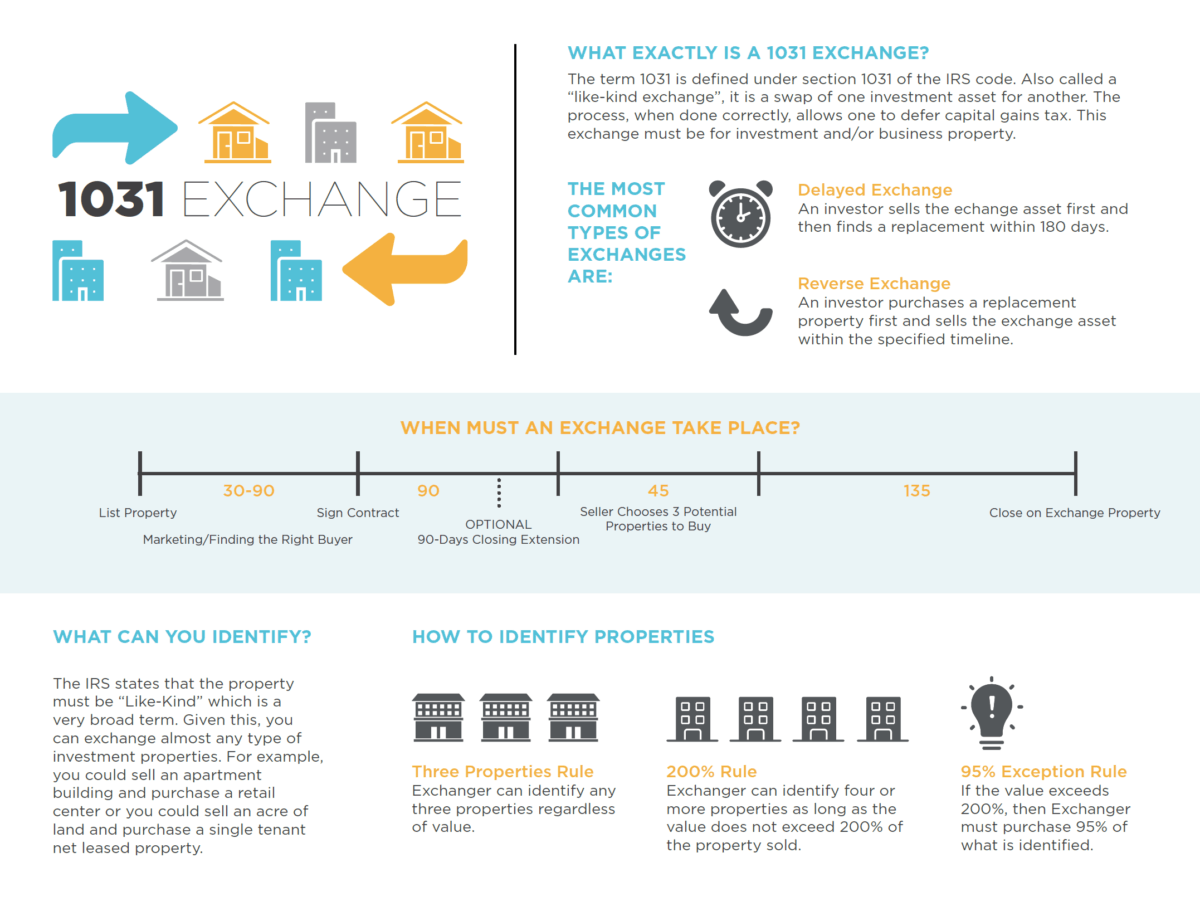

A 1031 exchange is a swap of properties that are held for business or investment purposes. The title comes from Section 1031 of the Internal Revenue Code. WHAT IS A 1031 TAX-DEFERRED EXCHANGE.

A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property. Learn More About Like-Kind Property Exchanges At Equity Advantage. Learn what a deferred 1031 exchange is and why its important.

Also known as Like-Kind. Enter the 1031 Tax Deferred Exchange. Section 1031 of the US.

Deferred Annuities Begins Disbursing Payments at a Future Date. Read More for Common FAQs. The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes.

Own Real Estate Without Dealing With the Tenants Toilets and Trash. Ad Exclusive off-market Delaware Statutory Trust offerings w6 - 8 starting cash flow. Ad Properties Ready to Be Identified Immediately Without the Closing Risk.

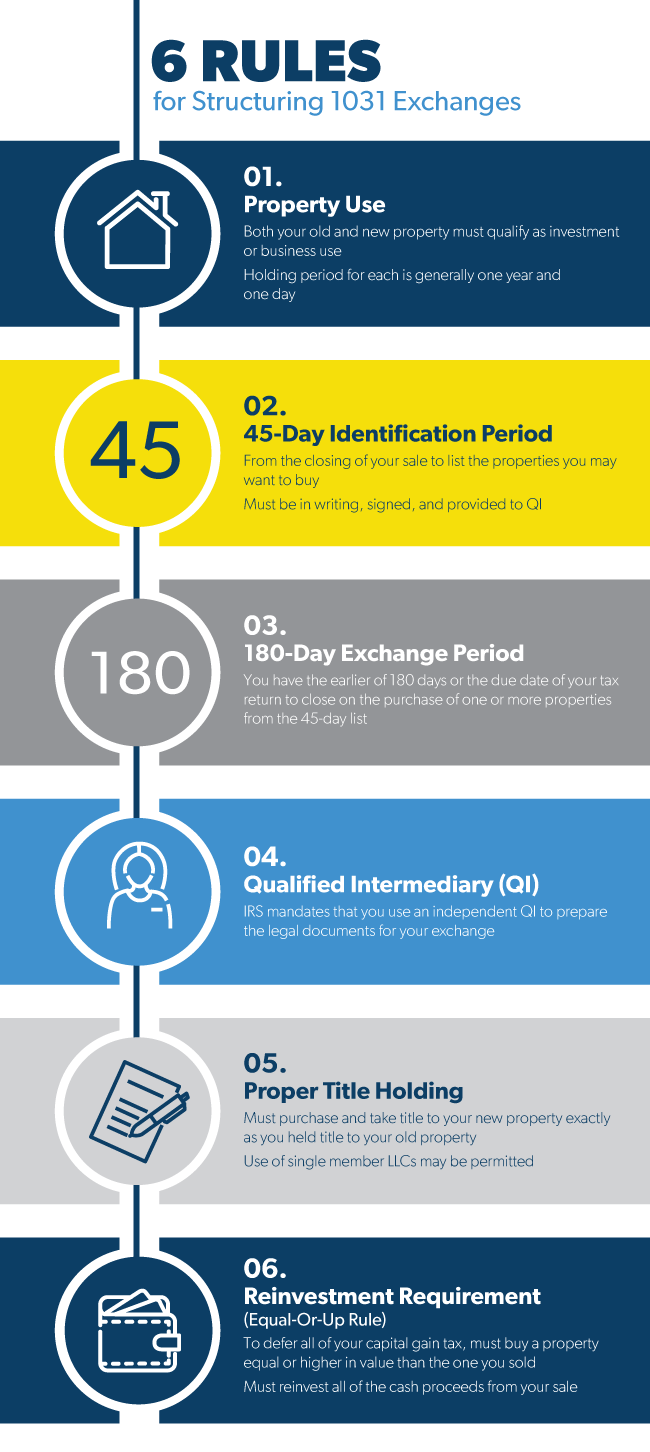

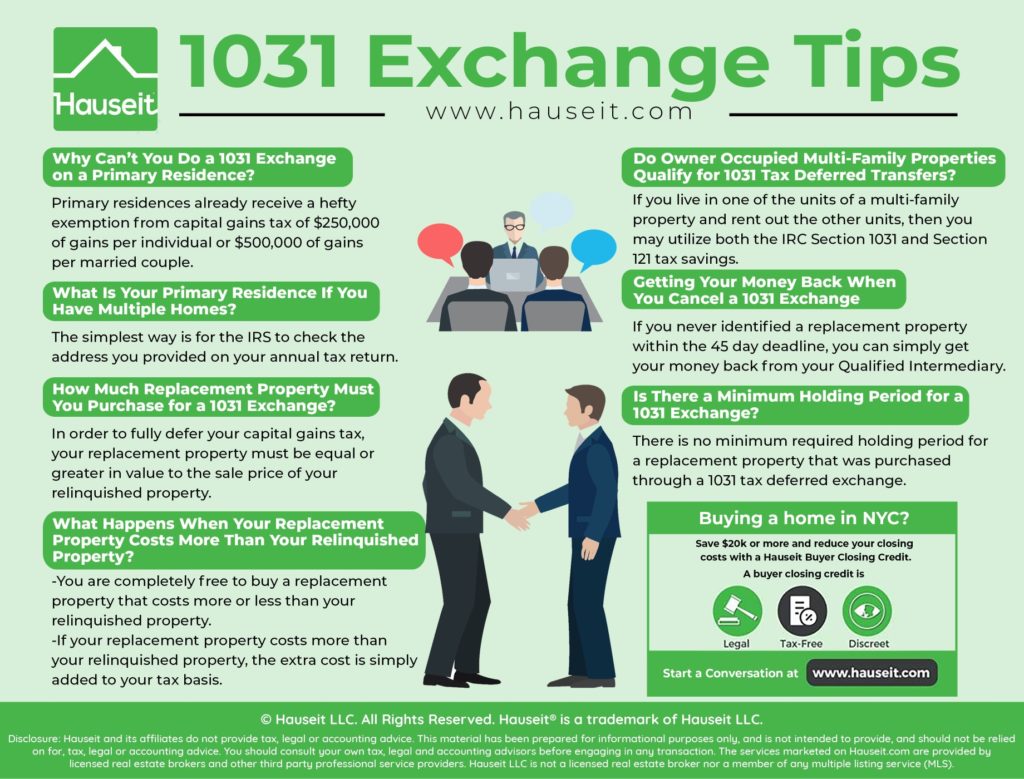

The properties being exchanged must be considered like-kind in the eyes of the. What Is a 1031 Exchange. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property.

1031 a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange. A 1031 Exchange also commonly called a Like-Kind aka Starker or Deferred Exchange refers to Section 1031 of the Internal Revenue Code that provides for the tax-deferred. Ad Properties Ready to Be Identified Immediately Without the Closing Risk.

The 1031 Exchange allows you to sell one or more appreciated rental or. A 1031 exchange lets you sell your business property or investment and buy a similar property with the deferment of the capital gain taxes. Tax code defines a 1031 exchange as a like-kind exchange of one investment property for another in which capital gains tax liability is deferred.

However by using the process of a 1031 tax-deferred exchange a. Deferred Annuities Begins Disbursing Payments at a Future Date. 1031 Exchange 1031 tax deferred exchange Real Estate Definition 1031 Exchange 1031 tax deferred exchange Under Section 1031 of the IRS Code some or all of the realized gain from.

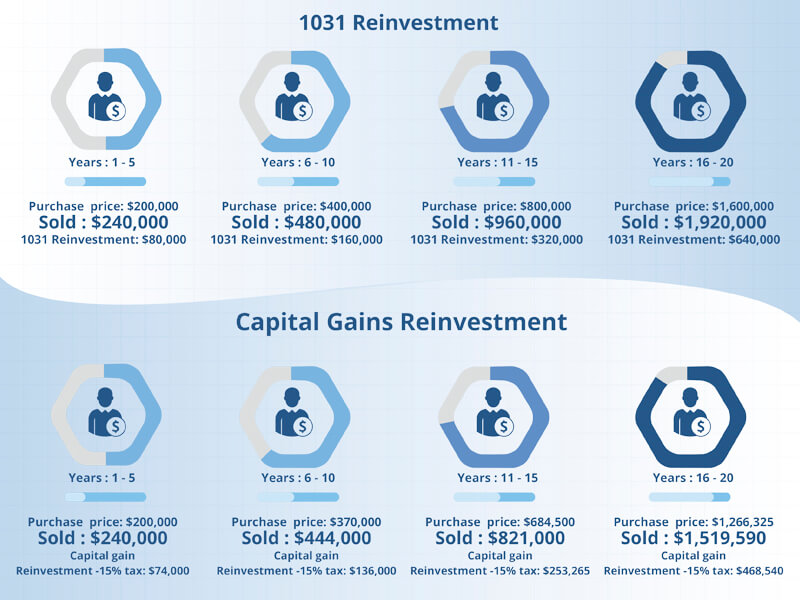

The Same Taxpayer Requirement in a 1031 Tax Deferred Exchange. Those taxes could run as high as 15. If that same investor used a 1031 tax deferred exchange with the same 25 down payment and 75 loan-to-value ratio they could reinvest the entire 200000.

The definition is vague. What Is A 1031 Tax Deferred Exchange. Attend A Free Webinar.

When selling real estate sellers can face significant tax obligations from the profit of the property sold. Why deal wtenants toilets trash. 1031 Exchanges are complex tax planning and wealth building strategies.

Basically a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits. To qualify as a section 1031 exchange a deferred exchange must be distinguished from the case of a taxpayer simply selling one property and using the proceeds to purchase another property. Its important to keep in mind though that a 1031 exchange may.

Under Section 1031 of the United States Internal Revenue Code 26 USC. Ad Maintain The Value Of Your Investment Property. A 1031 Tax Deferred Exchange offers taxpayers one of the last great opportunities to build wealth and save taxes.

What Is a 1031 Tax Deferred Exchange. That would allow for the. This code highlights the exemptions and rules to appropriately avoid paying.

A deferred exchange may help you capture tax benefits offered by a 1031 exchange.

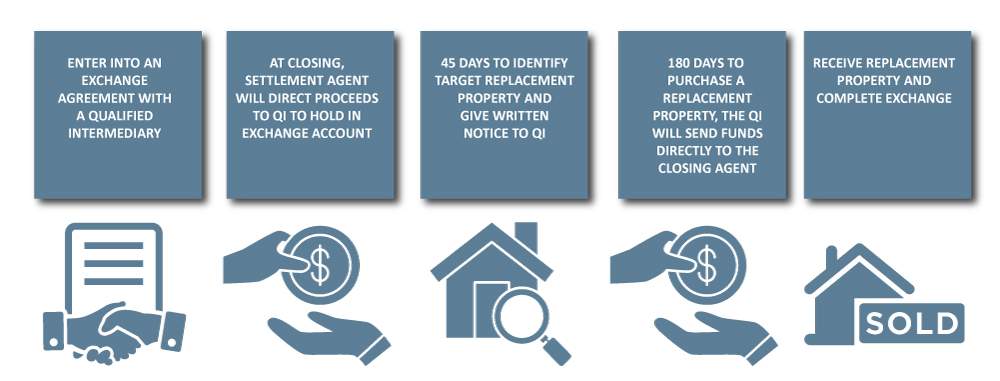

Delayed Exchange 1031 Tax Deferred Exchange Ipx1031

What Is A 1031 Exchange Mark D Mchale Associates

1031 Exchanges Rolling Over Funds Deferred Tax Strategy Makingnyc Home

What Is A 1031 Exchange Properties Paradise Blog

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

1031 Exchange Faqs 1031 Exchange Questions Answered

Are You Eligible For A 1031 Exchange

1031 Exchange The Basics Take Me Home Bend The Source Weekly Bend Oregon

Irc 1031 Exchange 2021 Https Www Serightesc Com

What Is A 1031 Exchange Commercial Real Estate Md Va Dc

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

1031 Exchange How You Can Avoid Or Offset Capital Gains

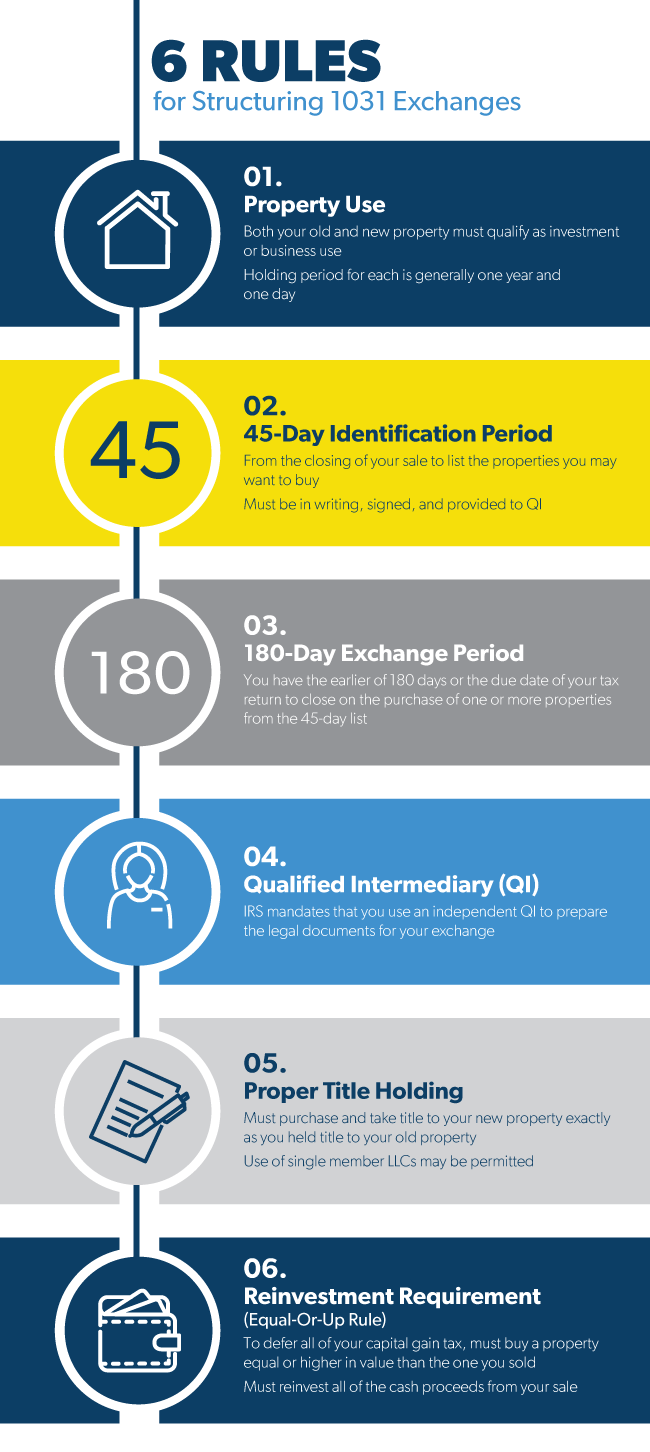

6 Steps To Understanding 1031 Exchange Rules Stessa

What Is A 1031 Exchange Asset Preservation Inc

1031 Exchange What Is It And How Does It Work Plum Lending

How To Do A 1031 Exchange In Nyc Hauseit New York City

Top 1031 Exchange Real Estate Strategy Tips For 2022 Nnndigitalnomad Com

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information